Why Rhumbix

Solutions

Use Cases

Contractor Type

Trade Contractor

Self Performing General Contractor

General Contractor

Project Owner

Public Sector

Use Case

Project Managers

Payroll & Accounting

Field Teams

Construction Operations

Specialty

Electrical

Mechanical

Plumbing

Painting & Drywall

Earth-moving

Glass & Glazing

Steel & Specialty Metals

Heavy Civil & Industrial

Drilling & Pipeline

Pricing

Resources

Log In

Planning for the Journey Ahead

Introduction

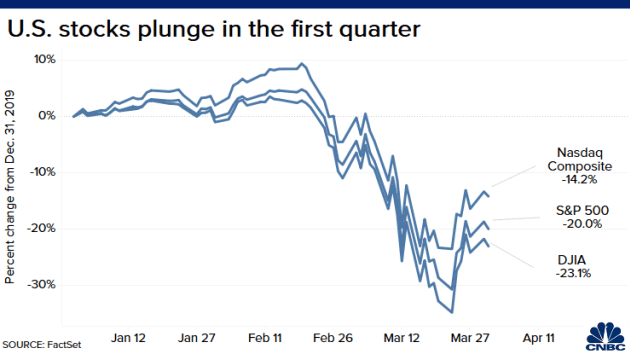

On Valentine’s Day, February 14th, 2020 the Dow Jones Index (DJIA) closed at 29,398, an all-time high. Fast forward six weeks to March 31st and the DJIA recorded the worst quarter in history with U.S. oil prices at an 18 year low.

Dramatic effect on the U.S. stock market after the pandemic’s initial wave in the United States. Most construction forecasts and company business plans were expecting solid growth for 2020 and beyond. Suddenly, the world turned upside down. The importance of “Safety First” in our industry took on a greater purpose.

While no one knows what’s going to happen with the economy and our industry when this pandemic ends, companies cannot assume we’ll be returning to business as usual. Similarly, a “doomsday prediction” for the construction market could prevent many firms from properly positioning for growth in a fast-paced recovery. A multi-pronged, multi-path business plan must be developed to address the economic scenarios that are possible.

Key Recovery Scenarios

The “V-Shaped” Recovery

Construction has fared far better in this crisis than other industries. Numerous state governments have designated construction as an essential service. While some firms continue to work, albeit, at a slower pace, all companies in our field have felt their administrative processes compromised.

Leaders across industries have begun evaluating current spending and projections. Construction is no different. This planning provides an opportunity to evaluate current business processes and expansion opportunities with an urgency that may never have occurred without COVID-19.

While planning, many teams will be reminded of just how well our markets and businesses were doing before this virus and economic disruption occurred. When the pandemic subsides, there is a chance that consumer confidence and industry outlook will quickly trend positive. In March, forecasters like Goldman Sachs forecasted a V-shaped recovery. Many construction companies similarly believed a rapid recovery was the most likely scenario. While this hope of a full rebound in the short-term may feel unlikely, it is worth anticipating this scenario as contractors in different regions may experience much speedier recoveries or project growth as their competition is forced to scale back labor and resources during this recovery period.

V-Shaped Recovery: Key Construction Considerations

- SCHEDULING AND RESOURCES: For firms anticipating a V-shaped recovery, validation of schedules, supplies, and resources must be in sync with owners, subcontractors, and suppliers. Anticipating and planning for disruptions in supply chains is essential to avoid bottlenecks.

- UNDERSTAND SHORT-TERM FINANCIAL OPTIONS: Federal stimulus will be crucial for some SMBs to survive long enough for the V-shaped recovery to be possible. As a General Contractor, you must re-qualify that subs and suppliers are and will be financially solvent.

- OVER-COMMUNICATE WITH EMPLOYEES AND CUSTOMERS: Including planned safety guidelines, monitoring employee and partner Jobsite access, plans for testing and tracking worker safety, mitigation of any negative impact, and full transparency in your confidence for the recovery.

The L-Shaped Recovery (Recession)

The more severe the pandemic, the less likely we’ll see a V-Shaped recovery. An L-shaped recession like in 2008-2009 becomes the more likely option. Our industry had profitable years during the recession due to our accumulated backlog, but new sales dropped. Post-recession (2010 – 2014) were the worst years for capital spending. Our industry lost over 2.3 million jobs to layoffs, static wages, early retirement, and workers leaving the industry. Review the lessons learned from the 2008 recession and update considerations for a similar L-shaped recovery.

L-Shaped Recovery: Key Construction Considerations

- STRESS TEST THE P&L AND BALANCE SHEET: Costs, revenue, working capital, CapEx, etc. Build upside and (extreme) downside scenarios. Talk to customers about their forecasts.

- PROCESS AND SYSTEM IMPROVEMENT: One major frustration employees have is dealing with inefficiencies in your business systems and processes. When this crisis is over, your company cannot go back to using the same procedures. Take an inventory and develop plans to either re-engineer, integrate, standardize or eliminate (RISE) these processes. Provide LEAN construction training for your team. Get them involved in identifying waste and opportunities for improvement.

- OVER-COMMUNICATE WITH YOUR EMPLOYEES AND CUSTOMERS: Same as the V-shaped recovery, but with additional transparency on potential cost reductions. Be transparent with employees. Manage investor relations (public, ESOP, private, etc). Focus on positive plans to make the company stronger during this time. Drive employee engagement. Have them develop an engagement strategy, not HR. The primary goal is to build employee and customer confidence.

The Hybrid Recovery (Market-based)

The reality is that neither shape may fit this recovery. Some industries that construction supports may be fundamentally changed, forever. For example, schools and hospitals may not look the same. Work-from-home may dramatically increase impacting commercial office space. As industries internally assess how they fared during this crisis, company strategies will change. Some industries will see boom times ahead; some will be forever changed.

Hybrid Recovery: Key Construction Considerations

- DEEPLY REVIEW MARKETS WHERE YOU CURRENTLY OPERATE: Some of these markets may be at high risk for failure. A “new” normal will come out of this crisis. What can your firm do to take advantage of this change? Evaluate markets, as well as, geographies that may see a major hit or boom. Look for M&A opportunities.

- RETOOL AND REASSIGN RESOURCES TOWARD FUTURE GROWTH: Create contingency plans for every aspect of your business. Be prepared to adjust plans as markets change. Invest in technology to streamline operations and incentivize staff.

- OVER-COMMUNICATE WITH EMPLOYEES AND CUSTOMERS: Of critical importance will be developing your strategy for building trust, loyalty and market share with employees and business partners.

Planning The Journey Ahead

Expect a long complex journey to recovery. Short-term, long-term, and daily operations need a course correction. Developing a plan assuming only one scenario is not practical. Plans must be based on each scenario.

Revising Your Strategic Plan: Multi-path Scenarios

Daily operations and short/long-term plans have changed. Multi-year strategic plans are back on the table. If we assume a V-shaped recovery, businesses will fail if it doesn’t materialize. If an L-shaped recovery is a realistic scenario, and the economy gets another boost, like an additional infrastructure stimulus plan, you need to be ready to turn plans into action when opportunity presents itself.

Management teams, across the industry, have been reactionary for weeks, changing day-to-day operations. Your management team must begin forming a planning team(s) tasked with looking past the pandemic and revising short and long-range goals. The team must base decisions on each of the potential recovery scenarios, not just one:

- Assuming a fast V-shaped recovery: Project priorities, deadlines, and resourcing plans will need adjustment. Additional resources (from a finite pool of people) will be needed to meet hard deadlines.

- Assuming a slow L-shaped recovery: Consider how to mitigate months of economic impact. Hard decisions on workforce realignment, re-tooling skills, and devoting time to improving technology and business processes.

- Assuming a Hybrid recovery: Some markets will take off rapidly. Others may be permanently impacted. Your team must assess each market and consider higher, lower, or elimination of focus. Similar to 2008, there will be changes this time around too. Now is the time to assess new markets, and establish new products/services. At the end of the day, some markets will die, some will be born, and new directions will be set.

Planning is an Exercise in Forecasting Probabilities

As part of any planning, we must factor in the “other” things that worried us before this crisis. In the 4th quarter of 2019, all was generally good in the industry. Forecasters were optimistic about the year ahead, but there were concerns that could impact 2020 performance including:

| Near-Term | Intermittent | Long-Term |

| High Tariffs | Trade Wars | Skilled Labor Shortage |

| Weaker Consumer and Business Confidence | Global Unrest / Military Events | Flat Productivity/Ineffective Processes |

| 2020 Election Year | Elevated Levels of Debt | |

| Softening Corporate Earnings | ||

| Rebounding Inflation (including energy prices) |

Each of these risks carries varying degrees of probability. The CEO cannot control or influence everything. Thus, what your company worries about and how it could impact your plan is unique. Consequently, the CEO/Planning Team must assess each item based on Stephen Covey’s Circle of Control.

Regardless of The Scenario, Take Foundational Action NOW

In addition to developing a multiple-path business plan, specific action must be taken around People, Process/Systems, and Business Continuity. People and Process/Systems will drive the plan. Business Continuity will mitigate the impact of a similar crisis in the future.

1. People:

Since the 2008 recession, many contractors have been taking aggressive action to combat the skilled labor shortage. According to Fortune Magazine: “…the unemployed total sits above 17 million—a number more massive than the Great Recession’s peak of 14.7 million in June 2009. In fact, 17 million unemployed Americans would be the highest level in the country’s history…”.

If we go into a recession, we’re likely to see a higher exodus of skilled labor. As a result of the coronavirus, we’re seeing many industries lay off workers in droves. Some of these jobs may never come back.

While it takes time for inexperienced workers to become skilled, this is an excellent time to be partnering with Trade Organizations, Tech Schools, and Universities for mass training for the trades. This need is crucial, regardless of the path that our recovery takes.

2. Process/Systems:

Our industry has the reputation of having the most fragmented business processes of any industry. While we “may” be in a lull for an extended period, this is not the time to wait for economic recovery using fragmented processes. We must adopt LEAN Construction principles while investing in technology enabling data-driven workflows that measure and reduce wasted time.

During the 2008 recession, many companies updated their ERP system and began the introduction of mobile-based Project Management Systems. These technologies, along with other mobile platforms contributed to a permanent change in construction processes.

Since the last recession, companies are expecting their ERP systems to integrate better with Field Systems. For companies with ERP systems that do not integrate Project Management and other Field Technologies, now is the time for an assessment and for implementing a new system.

Fundamental investments in Project Management/Field Systems to measure and improve material tracking, labor tracking, and field productivity are important. The message? Prepare the company to do more with fewer people, no matter which direction the economy takes.

If we have a V-shaped recovery, we need to ensure systems are efficient and integrated with other company systems. If we are headed for an L-shaped recovery, there is a need for systems allowing employees to do more with less staff. Cutting G&A costs is very common during recessionary times. If companies simply cut costs, they are not doing anything to prepare for the eventual journey back to profitability.

3. Business Continuity Plan:

Coronavirus caught everyone off guard. Rare was the company that had defined assignments in communications, employee safety, alternate work arrangements, back-office operations, and so on. Here’s what we know about recessions… they begin, and they end. What we don’t know is when a recession will begin, when will it end, and what the long-term effects will be.

Persuading a construction management team to commit time and resources for developing a Business Continuity Plan is difficult. However, the stakes are too high to not be prepared if there is a next time. It is the responsibility of the leadership team to assure employees, customers, and other stakeholders that you will have a plan of action if and when a similar crisis occurs.

Conclusion

Years ago, Winston Churchill said, “Those who fail to learn from history are condemned to repeat it.” Take this time to reassess your company’s response; not only to this pandemic but also, to future markets and forces that will shape construction for decades to come. Reassess and revise your long-range plan and make a commitment to invest in people and systems for the time when “normal” returns. Stay safe. Anticipate and act. Now is the beginning of a new journey forward!

[author] [author_image timthumb=’on’]https://rhumbixcms.wpengine.com/wp-content/uploads/2020/05/MO.jpeg[/author_image] [author_info]Michael Oster founded Gemba Technologies in 2016. Gemba Technologies provides CIO Services for the Construction Industry including the development of IT Strategies, process re-engineering services, cloud strategies, disaster recovery plans, security strategies, and Field technologies. Prior to founding Gemba Technologies, Mr. Oster was the Chief Information Officer for McCarthy Building Companies, a multi-billion-dollar construction firm, for 18 years. Oster holds a B.S. in Computer Science from Maryville University and a Master’s Degree in Information Management from Washington University in St. Louis.[/author_info] [/author]

Related Posts

- Technology’s Role in The Future of Construction

- Build Efficiency with Digital Timekeeping and Production Tracking

- Construction Tech Trends: #10 Business Intelligence